Why Africa is the next big market for cosmetics and beauty products

Dubbed as the next consumer hot spot, sub-Saharan Africa is experiencing the second-fastest economic growth in the world, only to be one step behind Asia-Pacific. As a result, the African economy is home to around 900 million consumers rushing to buy a wide range of cosmetics and beauty products. In fact, by 2030 sub-Saharan Africa is expected to have an economy that is worth around $3 trillion, the same value as that of the Russian economy today. East Africa alone is home to over 350 million people, where consumer spending is expected to grow to $250 billion in 2030. Sub-Saharan Africa could be the next big growth region due to its high birth rates and a rising middle class. The market leaders – South Africa and Nigeria – will be followed by five key frontier markets: Kenya, Ethiopia, Tanzania, Ghana and Cameroon.

Dubbed as the next consumer hot spot, sub-Saharan Africa is experiencing the second-fastest economic growth in the world, only to be one step behind Asia-Pacific. As a result, the African economy is home to around 900 million consumers rushing to buy a wide range of cosmetics and beauty products. In fact, by 2030 sub-Saharan Africa is expected to have an economy that is worth around $3 trillion, the same value as that of the Russian economy today. East Africa alone is home to over 350 million people, where consumer spending is expected to grow to $250 billion in 2030. Sub-Saharan Africa could be the next big growth region due to its high birth rates and a rising middle class. The market leaders – South Africa and Nigeria – will be followed by five key frontier markets: Kenya, Ethiopia, Tanzania, Ghana and Cameroon.

Why Africa?

Africa is home to more than one billion people, which, compounded with high population growth and a shifting demographic profile (positively correlated with a rise in disposable income), presents vast potential for the consumer market. The African region as a whole is forecast to be home to close to three billion people by 2065 (from one billion currently) – more than the projected combined populations of China and India at that time. Thus, looking solely at the size of the consumer market, the potential of the African market is immense. By 2030, Africa’s top 18 cities could have a combined spending power of $1.3trillion, making the continent a target for companies seeking growth outside developed countries.

Africa’s wealthy class is growing. In 2023 the region’s segment of high-net-worth individuals (HNWI) grew by 9%, the second-highest growth rate in the world after North America. The number of dollar millionaires in the Kenyan capital, Nairobi, is expected to spike 62% to over 8,000 dollar millionaires. Kenya’s Social Class A is projected to grow 28% till 2020, one of the highest forecasts in the world; in China, for example, the Social Class A is only set to grow 4% to 2030.

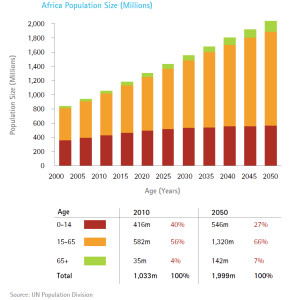

The population size of Africa is estimated by the United Nations (UN) Population Division at 1.15 billion in 2014, where Sub Saharan Africa (SSA) accounts for 81% of Africa’s total population – notable population sizes include Ethiopia, Egypt, Nigeria and the Democratic Republic of the Congo (DRC). Populations are set to increase by as much as 70% in Uganda and 65% in Tanzania – thereby making these countries a target for major international cosmetics companies and other FMCG multinationals. However, it is important to consider that population size alone and growth do not have an unambiguous effect on market attractiveness. While on the one hand, a higher population size boosts the number of consumers that a retailer has access to in a country, a lower population implies greater wealth per capita; a crucial factor for luxury good consumption.

Yes, Africa’s middle-class has tripled in size in the last 30 years and is driving the continent’s demand for cosmetics. As a result, cosmetics companies are racing for market share. While multinational brands dominate the market in Kenya and Uganda and lack of capacity for local manufacturing remains an issue, local entrepreneurs are outsourcing manufacturing and are using unique sales strategies. The push towards East African markets is also an indirect consequence of South Africa, the continent’s most mature market, seeing local economic difficulties dampen demand for premium products.

Yes, Africa’s middle-class has tripled in size in the last 30 years and is driving the continent’s demand for cosmetics. As a result, cosmetics companies are racing for market share. While multinational brands dominate the market in Kenya and Uganda and lack of capacity for local manufacturing remains an issue, local entrepreneurs are outsourcing manufacturing and are using unique sales strategies. The push towards East African markets is also an indirect consequence of South Africa, the continent’s most mature market, seeing local economic difficulties dampen demand for premium products.

Perhaps an added advantage for sub-Saharan Africa is that 70% of its population is under 30 which means that most of the people are young and provide a ready market for luxury goods which includes cosmetics, toiletries and perfumes.

The westernisation of African consumer preferences, advances in aggregate economic conditions, and projected reduction in dependency ratios (the proportion of the total number of dependents in the country – i.e. those younger than 15 and those aged 65 and older – to the working-age population) all point towards a future growth engine of luxury goods demand – such as beauty products, cosmetics and perfumes in the overall East African market.

More and more women in the study area of East Africa are overcoming the fear of powdering their face and have hence embraced the use of cosmetics for their personal grooming. Men have also followed suit and are frequently seen in beauty parlours for manicure, pedicure and haricuts.

Increasing urbanization

Cities attract and concentrate about 40% of the total African population and are expected to exceed 700 million individuals by 2030. This urbanization represents a positive trend for the Beauty and Personal Care market, since urban consumers are wealthier (urban incomes per capita are on average 80% higher than those of countries as a whole, according to Canback Global Income Distribution Database), their spending trend is twice as fast as rural spending and they are more easily reached by brands thanks to their geographical concentration in specific areas.